TRX Price Prediction: Bullish Momentum Builds Amid Positive Catalysts

#TRX

- TRX trading above key moving average shows bullish trend

- Positive MACD crossover indicates strengthening momentum

- Regulatory developments creating favorable market conditions

TRX Price Prediction

TRX Technical Analysis: Bullish Signals Emerging

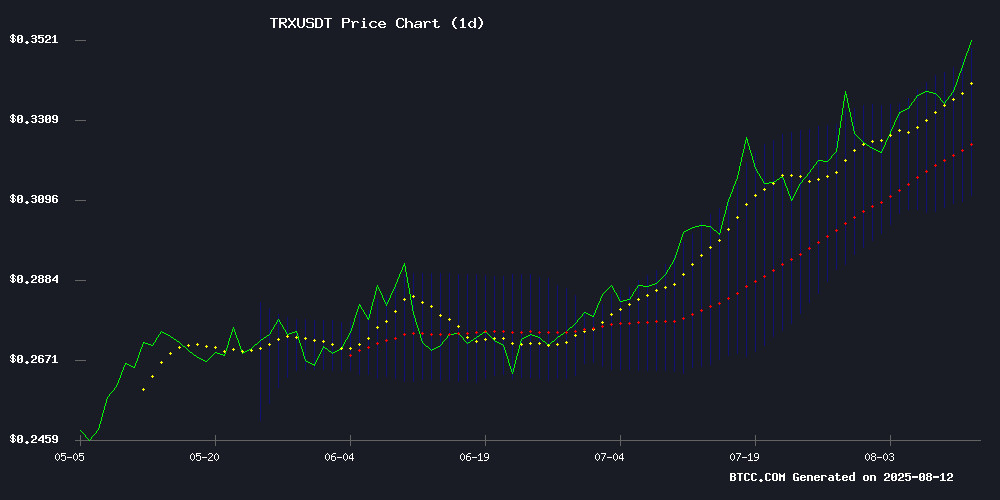

TRX is currently trading at $0.3457, above its 20-day moving average of $0.330075, indicating a bullish trend. The MACD shows a positive crossover with the histogram at 0.001351, suggesting upward momentum. Bollinger Bands reveal the price is NEAR the upper band at $0.348386, which could act as resistance. Analyst Ava from BTCC notes that if TRX breaks this level, we might see a test of $0.36 next.

Market Sentiment Boosted by Regulatory and Adoption News

Recent news of Tether and Tron freezing $250M in criminal assets has strengthened confidence in TRX's ecosystem. Additionally, Trump's executive order allowing 401(k) plans to include cryptocurrencies could increase institutional demand. Ava from BTCC highlights that these developments, combined with TRX holding above $0.34, create a favorable environment for further price appreciation.

Factors Influencing TRX’s Price

Tether and Tron-Backed T3 Unit Freezes $250M in Criminal Crypto Assets

The T3 Financial Crime Unit, a collaboration between Tron, Tether, and TRM Labs, has frozen over $250 million in illicit assets within a year of its launch. The initiative targets funds tied to money laundering, scams, and terrorism financing across five continents.

"Freezing over $250 million in illicit assets in less than a year is a powerful testament to what's possible when the industry comes together," said Tether CEO Paolo Ardoino. The unit has monitored $3 billion in transactions, including high-profile seizures from pig butchering scams and European crime networks.

A new program, T3+, aims to accelerate cross-border investigations by integrating exchanges and financial institutions into real-time enforcement. Binance, the first member, recently collaborated with T3 to freeze $6 million linked to a pig butchering scheme.

Tron Price Holds Above $0.34, Will the Rally Sustain for Another Breakout?

Tron has re-emerged as a market standout, breaking decisively above the $0.30 resistance level after months of stagnation. The cryptocurrency now trades at $0.3473, marking a 1.97% daily gain and a 4.55% weekly increase. Trading volume surged 37% to $1.06 billion, propelling its market capitalization to $32.88 billion.

Technical indicators suggest potential near-term consolidation. The RSI reading of 71.61 signals overbought conditions, though the bullish structure remains intact above key supports at $0.3329 and $0.30. Immediate resistance lies at $0.3486, with further upside targets at $0.3650 and $0.3802 should momentum persist.

Trump's Executive Order Opens 401(k) Plans to Cryptocurrencies and Alternative Investments

President Donald Trump has signed an executive order that could revolutionize retirement savings in the United States. The directive mandates a review of existing ERISA rules by the Department of Labor, SEC, and Treasury Department to allow 401(k) plans to include cryptocurrencies, private equity, and real estate investments. This move potentially unlocks a $12 trillion market for alternative assets.

The decision bridges traditional finance with emerging asset classes, offering millions of Americans exposure to high-growth but volatile investments. While private equity has historically outperformed the S&P 500 by 3 percentage points annually, crypto assets bring unprecedented volatility to retirement portfolios. The policy shift reflects growing institutional recognition of digital assets despite their speculative nature.

Critics warn of increased risk exposure for retirement savers, while proponents highlight the potential for enhanced long-term returns. The change affects employer-sponsored 401(k) plans, which currently benefit from tax advantages and matching contributions. This development marks a significant milestone in cryptocurrency's journey toward mainstream financial adoption.

How High Will TRX Price Go?

Based on current technicals and news catalysts, TRX has strong potential to reach $0.36-$0.38 in the near term. Key levels to watch:

| Indicator | Value | Implication |

|---|---|---|

| Current Price | $0.3457 | Above 20-day MA |

| Upper Bollinger | $0.3484 | Immediate resistance |

| MACD | Positive | Bullish momentum |

Ava from BTCC suggests watching the $0.3484 breakout for confirmation of next leg up.